Is the elusive “Bloomberg for the masses” attainable? Of course, most do-it-yourself investors cannot afford the cost of thousands of dollars per month for these expensive terminals. But, what about making a platform free for subscribers and monetizing the platform via advertising?

That’s exactly what SkyGrid is attempting. Until recently, SkyGrid charged $6000 per seat/year for a flash interface that allows users to track financial news on stocks and sectors they’re interested in. In April, the company, which raised $11M in April from top venture firms, transitioned away from a premium model to a completely free model. SkyGrid has made free accounts available to New Rules of Investing readers. If you’re interested, go here to sign up for a free account: http://www.skygrid.com/reg/?id=8x89a9e3

The Service

SkyGrid users log in to their accounts over the web via their browsers. Once in, users are greeted with the only human-arranged editorial component on the platform: the day’s top or breaking financial stories.

SkyGrid produces a user-defined customizable news-stream. Users of the system can customize SkyGrid to continuously stream stories about stocks in their portfolios. SkyGrid compiles this content based on what the company described as a complex, multi-step process that includes:

- crawling/scraping data/headlines from feeds in real time

- validating reputation (link structure, click volumes) to weed out only content appropriate for a high-end user, like a hedge fund manager

- testing if the content is important/impactful for investors (Steve Jobs = important for Apple),

- applying sentiment indicators (green if the content is positive, red if it’s not) via semantic analysis developed by computational linguists (something the firm says is very different from keyword analysis)

- real time clustering (grouping various articles around similar themes)

The upshot is that users get a vertical stream of headlines which they can click through to read the entire article.

Pros:

- The system works really quickly and it appears to be eerily on target with its content.

- I found very few articles streaming by that weren’t interesting or important for shareholders.

- I believe this comes from good science, programming, user interface and tying it all together, a focus on investors. SkyGrid has developed this for investor use and investor use only and it shows.

- It even follows Twitter streams where more and more investment content is being shared

Cons:

- This may be another case of coming to a knife fight with a gun or a solution looking for a problem. I found the amount of information hard to digest. As an hedge fund analyst, I was paid to discover profitable investments. Does actually having this amount of information make me better at that? I’m not convinced.

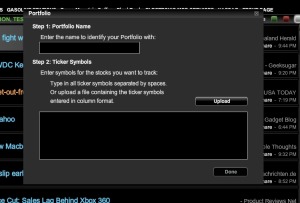

Building News Streams

Because SkyGrid is a smart, content aggregator built with investors in mind (as opposed to some of their competitors that are merely trying to sell to investors), SkyGrid has some interesting functionality when it comes to customization of news streams.

- Uploading tickers of portfolio: for institutional investors monitoring lots of stocks, the ability to upload a list of tickers makes it really easy to set up

- Sector analysis: I like what SkyGrid has done here. Instead of using old-hack sectoror industry number/jargon, SkyGrid allows investors to monitor sectors the way they think about investing in them. So, no “information retrieval” for “web portals” or “hardware components” for “consumer electronics”. This isn’t trivial and is quite useful.

Pros:

- customizing a news stream is really easy on SkyGrid.

- upload function is really helpful for professionals or retail investors monitoring a lot of positions

- sector tools approach industry analysis the way investors do, not like the Dewey Decimal system does

- Good filter system gives users ability to tune out blogs, mainstream media, news wires, etc.

Cons:

- I’d like more help here with idea generation. For many investors, they know exactly what they want to monitor. Others need help. Maybe pre-seeded news streams with commonly held stocks could help. Or maybe seeing celebrity investors’ news streams could help prod users for ideas. I think more work here will help many retail investors as well as professionals who are less web-savvy.

- While the filtering provided allows investors to tune out certain types of sources, it would be more interesting to filter out specific sources. Maybe I’m interested in TechCrunch. Or maybe I’m not. I’d like to be able to decide as I go to amplify or drown out certain sources.

Social components

There are a few important components built-in on SkyGrid that connects the platform to the greater whitespace of social networks:

- Each of the streaming headlines can be easily posted to social networks like Twitter, adding to the virality of the platform, though it’s unclear to me if there are any beneficial network effects for users by having additional users on the platform (it’s clearly good for SkyGrid’s marketing and distrubition).

- The customizable news-stream can be shared out with others, much in the way content aggregator, Alltop allows users to create my.alltop.com (see my.alltop.com/zackmiller, as an example)

- Users can rate that they like certain articles. These articles are then tagged so users can revisit them. At the aggregate level, there is even some rudimentary ranking of top favorited items.

Pros:

- Basic sharing functionality outside of the SkyGrid platform onto social networks.

Cons:

- There don’t seem to be any (easy to find, at least) internal social components. I’d like more insight into others’ news streams. That voyeurism works well for me and on the web in general. We’re seeing portfolio peeking in expert investing communities, like Covestor.

- analytics: I can’t put my finger on it exactly but there is probably some interesting stuff to be done here with meta information that would be useful for investors. I’d like to see some data (ie., 76% of articles on Apple are normally positive, today shows only 25% — maybe the beginning of a turn in sentiment)

New Rules of Investing Overall Rating

Usability: Pass +

SkyGrid does everything it purports to do. It’s a great user experience to have an ongoing conversation stream of all the stocks and sectors in one’s portfolio. The filters are great — read only that content that’s pertinent to a shareholder. The rest is just noise and SkyGrid tunes it out.

New Rules Meter: Pass-

This is a level of how Web 2.0 the site actually is. The site scrapes and analyzes content really well but doesn’t do a great job of sharing/producing content withing its own 4 walls. Unlike Twitter, which combines both external content and commentary on top of it, SkyGrid seems a pretty static environment at this point. Because we’re dealing with financial information, this could certainly be by design but it would be interesting to create some type of network effect, where users can also create content and share.

Needs Fulfillment: Questionable

It’s here that I struggle. SkyGrid does what it does quite well. I’m just not convinced anyone really NEEDS it. Combine a chintzy Yahoo Finance with StockTwits and a good blog aggregator like Google Reader and how much do you really miss? SkyGrid is another program that demands attention. I like to keep a separate window open on a separate screen from where I’m looking just to let it scroll — much in the same way I use the Twitter client, TweetDeck. I like it but just not sure how ultimately valuable this is. It’s like half-listening into a conference call or letting CNBC play in the background.

That’s just me — what do you think? What are your perspectives on SkyGrid?

I’m going to use a future post to delve into the business model — turning an institutional-grade investment platform into an ad-supported thin client. Stay tuned.

SkyGrid has made free accounts available to New Rules of Investing readers. If you’re interested, go here to sign up for a free account: http://www.skygrid.com/reg/?id=8x89a9e3

Like what you’ve read? Don’t forget to subscribe to receive free daily updates from New Rules o fInvesting. You can also follow us on Twitter.